Paper cut?

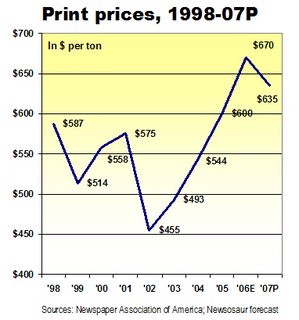

After rising nearly 50% since 2002, newsprint topped out near $700 per metric ton earlier this year and began declining over the summer to about $670 as the result of weak demand. Newspapers are buying less pulp for three reasons: Lower circulation, reduced advertising lineage and tighter newsholes.

Newsprint generally represents about 10% to 15% of the operating expenses of a newspaper. Price increases – unless offset by reduced consumption – eat directly into the bottom line. So long as revenues are at least stable next year, cheaper print should make it easier for newspapers to make their numbers.

With Chinese mills efficiently cranking out more print than can be used in their country, their output is expected to begin landing on the West Coast within a matter of months, according to Mark Wilde of Deutsche Bank and other industry analysts.

“The Chinese won't just come in $5 to $10 per metric ton below the market,” says Mark. “They could come in $25 to $50 below market to buy themselves volume.”

At that rate, the price for newsprint could drop as low as $620 per ton next year, delivering a savings of approximately $450,000,000 to the industry, assuming that consumption remains near the estimated 9 million metric tons expected to be purchased this year.

Recent evidence suggests that newsprint consumption will continue to fall. After peaking at more than 12 million tons per year in 2000, consumption dropped to a bit more than 9.6 million tons in 1995, according to the Newspaper Association of America, the industry trade group.

Propelled by aggressive paper price increases and even more aggressive efforts to defend their shrinking profit margins, publishers have been making newspapers shorter and skinnier in order to cut pulp consumption. Last year and this, many newspapers shortened their pages to save on paper. They also have eliminated stock listings and squeezed their ad-to-edit ratios to tighten print consumption.

With newsprint demand already soft, the last thing North American pulp producers need is an influx of cheaper product from China. Like it or not, says Mark, the North American producers will be forced to match the lower import pricing – and probably also will cut production in an effort to prevent unsold product from clogging the market and putting more downward pressure on prices.

Though pulp friction may bad news for paper makers, it could be a plus for publishers.

<< Home