Some papers see Q1 sales rise – first since 2006

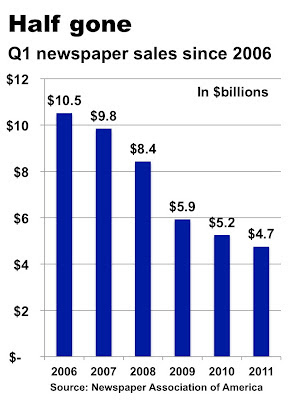

The last time newspaper ad sales grew in the first quarter was 2006, when combined industry revenues rose 0.35% from the prior year to $11.1 billion. In 2011, print and digital ad sales in the first three months were a bit under $5.6 billion, or fully 50% less than they were five years earlier.

With a month to go in this quarter, a number of publishers anecdotally reported last week at a convention in San Antonio that improved retail and employment advertising had put their sales ahead of those in 2011. The uptick was not universal, and, of course, could be derailed by any number of local, national or international events.

However, there was a notable sense of relief, if not to say cautious optimism, among several of the newspaper executives attending the combined confab of the Inland Press Association, the Local Media Association and the Southern Newspaper Publishers Association.

In a series of informal conversations, some publishers counted it as a victory that their numbers in the first two months of 2012 were equal to those of the prior year. Others reported that their sales met or surpassed conservative budgets that forecast single-digit declines between this year and last.

“It looks like the cycle finally has turned,” said an executive who could not discuss specifics of his company's sales because it is publicly traded. “People counting out newspapers have not taken into account the effect of the weak economy. It won’t take much of an improvement [in the economy] for us to see real increases in profitability after the cost-cutting we have be doing for the last several years.”

While a turn in the economy is bound to be helpful, it must be noted that every other medium has long since rebounded from the Great Recession, which technically ended by mid-2010 (though it is of little consolation to those continuing to suffer from foreclosure, unemployment and financially challenged retirement).

In the first quarter of 2011 – that’s right, a full year ago – Internet ad sales soared 14.6%, television ad sales advanced 5.3%, magazine ad sales rose 4.5% and radio ad sales gained 1.3%, according to Kantar Media. In the same period, newspaper sales fell 7.2%, according to the Newspaper Association of America.

While publishers have been perfecting the fine art of doing more with less (or sometimes less with less), vigorous competitors like Groupon and Yelp have been filling their coffers at the IPO window to pursue ever more local ad dollars. And that’s not to mention such big kahunas as Google and Facebook, the latter of which will add tens of billions to its marketing war chest when it goes public in the very near future.

You can't begrudge beleaguered publishers for wanting to pop a cork if they happen to have a positive first quarter. In light of the gathering competitive assault, however, they would be wise to choose inexpensive vintages and put the balance of their extra profits into beefing up their digital offerings.

5 Comments:

Interesting to compare what you heard at the confab, Alan, with the new Pew study of how newspapers are -- or aren't -- confronting the revenue problem. The Pew study is deeply researched and quite depressing, except that it found evidence of a few bold and savvy operators beating the odds. You report your findings in a commendably neutral fashion. But what's your opinion: Were you talking to the bold and the savvy or the wishfully thinking?

--Mike Phillips

As I noted in another post, in addition to the onslaught of digital media, newspapers are suffering from poor customer service. A couple of months ago I contacted newspaper senior ad executives in the top 50 US markets to get rates for a client who was interested in advertising in many of them. To date, newspapers in 20 of those markets still haven't replied to numerous emails and telephone queries. Reminds me of the old days at The New York Times (before I got there in 1989) when no one answered the phone in the Ad Department after 3 pm because they'd sold out the advertising inventory. If I were a publisher today I'd hire someone to try to reach my sales staff and see if he or she could place an ad or get information. And I'd also hire someone to try to buy a subscription. It took me about nine weeks to get one from the LA Times!

... while it appears daily newspaper advertising revenues may be leveling off at less than 1/2 their "peak" the next major blow will be to their insert revenue; which is HUGE in their Sunday papers... and it contributes an 80% profit margin...if insert revenues fall off at the rate of classified then a lot more daily newspapers will be circling the drain...or going 3 days a week at best.. and their are several internet companies trying to do just that: Take away Sunday newspaper insert revenue... a honey pot of profits!!!

I am 32 years old. Me and most of my friends read the paper now. The paper paper- the FT and the NYT. When I am back home, I buy the local rag too. Of course the apps too. Granted, I am in a somewhat special case, having a job that pays more than the average, but one thing has dawned on me in the last 5 years- paying for news is worth it. I honestly don't have the time to fish around for free news on the net and I really dont care for the AP wire on Google News or Yahoo Finance. Internet news is frankly crap. I go to it for TMZ, Tech stuff and sometimes ESPN. I suppose I am a minority who pays, but was it ever above 50 percent in the last 40 years?

Interesting the note about the earlier rebound of other advertising media after the 'great recession'. It's worth noting that advertisers were jumping for the low hanging fruit at that point and were trying to stretch their ad dollars. At the paper where I work, we saw lots of advertisers jumping to do experiential and promotional sampling with a minimum ad buy vs. that huge full page colour piece they normally bought.

The dollars are still there, you just have to present your clients with options that make sense given the times. This is when you're going to see the silos that have built up around lazy ad sales departments start to come down as they begin to rely on other departments to provide the value to their clients.

Post a Comment

<< Home